This book takes readers on a journey through the evolution of India’s banking sector, from the nationalization of banks in 1969 to their pivotal role in shaping economic growth, particularly in agriculture and industry. Navigating Change delves into the major challenges confronting the banking industry today and offers insights into the transformative steps necessary for inclusive growth, technological adaptation, and sustainable banking practices. The book is not just a chronicle of banking evolution but also a guide for professionals looking to navigate the ever-changing financial landscape.

1. Can you provide a summary of your book and explain how it addresses key challenges in the modern banking sector?

Navigating Change explores the banking sector’s journey over the decades, analyzing its transition from traditional banking to a more dynamic, technology-driven model. The book highlights the key challenges the industry faces today, including:

- The need for transformation to drive inclusive economic growth.

- The integration of digital technologies to enhance customer experience.

- Moving beyond conventional lending towards a more solution-focused approach.

- Gaining a comprehensive understanding of the credit life cycle and effective risk management.

- Preparing banks to navigate a world characterized by Volatility, Uncertainty, Complexity, and Ambiguity (VUCA).

- The personal commitment required for professional excellence and leadership in banking.

2. What inspired you to write this book, and what experience do you bring to the subject?

The author has always valued continuous learning, skill development, and knowledge-sharing. His career progression—from a bank clerk to the Chairman and Managing Director of a leading bank, followed by his tenure as CEO of the Indian Banks’ Association (IBA)—inspired him to pen Navigating Change. Drawing from over four decades of experience in banking, finance, and leadership, the book encapsulates valuable insights and lessons learned from his journey, as well as interactions with professionals across the financial sector.

3. What are the key takeaways or lessons that readers can expect from your book?

The book offers readers valuable insights on:

- The significance of humility and dedication in achieving professional aspirations.

- The art of building high-performing teams and fostering leadership in others.

- Transforming challenges into opportunities for growth.

- The importance of customer-centricity in all business operations.

- A holistic understanding of self-awareness, business dynamics, customer expectations, and market competition.

4. Can you share any real-world examples or case studies from the book that illustrate its principles?

The book is enriched with real-life examples that highlight the core themes:

- Credit by Choice: As Chief Manager of the Overseas Branch in Mumbai, the author implemented a strategic approach to selecting credit clients based on Export Promotion Council data.

- Customer-Centric Leadership: On his first day as CMD of Central Bank of India, he emphasized to his employees that “You are my first customer,” reinforcing the idea that employee empowerment directly impacts customer service for the bank’s 30 million customers.

- Financial Inclusion: Throughout his career—from a Rural Bank Manager to CEO of IBA—he championed financial and digital literacy. Even today, he continues mentoring fintech startups and serving as an Independent Director on corporate boards, advocating for financial inclusion.

5. What challenges did you encounter while writing this book, and how did you overcome them?

The writing process faced disruptions due to the COVID-19 pandemic, slowing progress. Additionally, the author’s professional commitments as a mentor, advisor, and board member left limited time for writing. However, with the encouragement of close colleagues and a strong commitment to the project, he persevered and successfully completed the book.

6. What impact do you hope your book will have on readers?

The book is designed to inspire readers—especially young professionals and aspiring bankers—by demonstrating that dedication and perseverance can lead to remarkable achievements. It encourages self-assessment, adaptability, and ethical decision-making in financial and professional pursuits. Additionally, the emphasis on financial and digital literacy reinforces the author’s belief in banking’s role as a driver of inclusive economic growth.

7. How does your book remain relevant in an ever-changing world?

The principles of continuous learning, adaptability, and passion for one’s work are timeless. The author encourages readers to apply these core values to their unique career paths while staying agile in an evolving financial landscape. The book promotes the LEAP mindset—Learn, Excel, Adapt, Passion—as a strategy to remain relevant and succeed in any professional environment. By internalizing these lessons, readers can navigate change effectively, ensuring lasting success in their personal and professional lives.

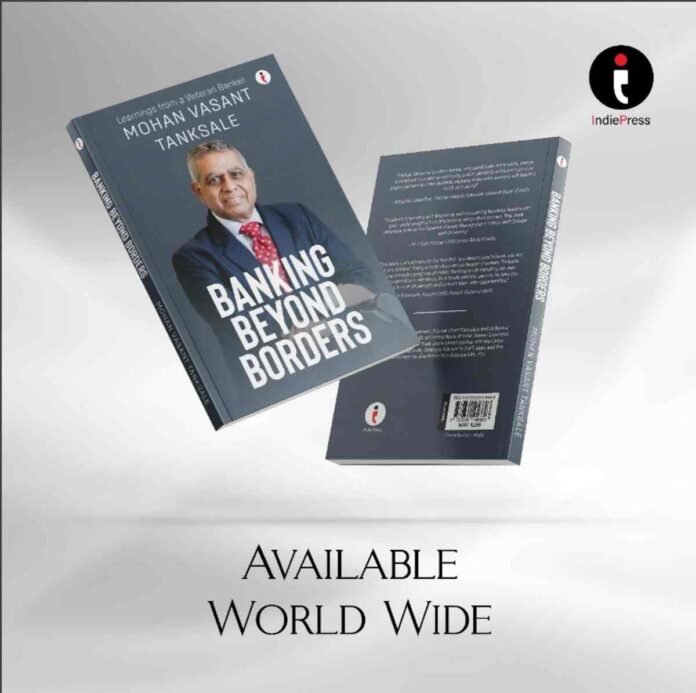

Navigating Change: Banking Beyond Borders: Learnings from a Veteran Banker is available now on Amazon. Discover the insights and experiences of a seasoned banker who has shaped the industry and learn how to navigate the dynamic world of finance with confidence.